With proper data management strategies, organizations can take their automated trading platforms to the next level. Data management ensures that the data stays accurate and consistent. It also makes sure that the data remains accessible and secured. That’s why automated trading can help in data management.

It may seem like a worthless activity to automate data management. Yet, as soon as you start generating massive data through reports and analysis performed on the markets’ ups and downs, you will need an automated trading platform for managing this built-up data. Over time, this build-up of data can slow down your existing algorithm or data managing techniques.

It is imperative for managers, traders, and executors to realize the potential of automated trading software in data management. Automated trading and data management tools simplify the data so that it can be processed much more easily. To understand more about the benefits of trading platforms in data management, a clear understanding of market data and automated trading is essential.

What is Market Data and Why Should You Care About it?

Market data is the financial data that has to be analyzed and accounted for before the actual trading occurs. It can have various functionality ranging from standard and simple services to complex and sophisticated data flow systems.

Data management thus refers to the handling of products and services that relate to market data and providers. The flow of data from proprietary sources and vendors occurs very smoothly.

What is Automated Data Trading?

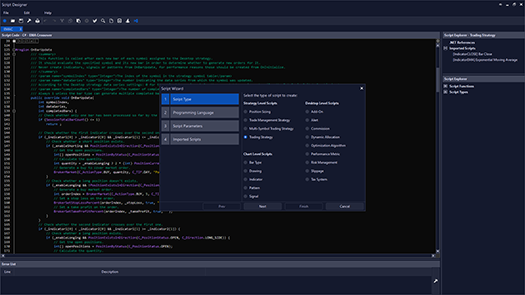

With the involvement of an automated trading platform, individuals or organizations can increase the efficiency at which faster trading strategies can occur. Through this method, the trader can participate in a market by merely setting the rules for entering, bidding, and exiting the market. In this way, multiple trades can be executed at the same time.

Since algorithmic trading takes the human emotions or gut feelings surrounding the trading, these algorithms, if properly trained, can bring in more profit than a human can. When it comes to data management in the field of automated trading, there is practically little or no involvement of humans, whether it is to check the data or perform analysis for the same.

This trend is growing as now; many banks are letting go of the trading teams in favor of automated trading systems that enhance trading efficiency.

Market Data Management and Automation

For balancing the market’s aggressiveness with the customer’s expectations, the automated trading platform can be used to create a center for market data management.

The Benefits of This Process Are:

Providing Support For Purchasing Process and Management of Contracts

This can create a favorable position for both the customer and contracts by investing in a vast enterprise.

Making a Unit Specifically for Automated Data Monitoring

This can help project outcomes that can be used to predict the favorable responses and actions, completely predicted by the trading algorithm. The algorithm will only provide the essential yet relevant information to you, reducing the errors.

Passing of Real-Time Information in the Trading Market

Using the previous data, a data management automated system can pass on the knowledge to the algorithm, which will then predict favorable options for investment. Information is passed on swiftly, and real-time accumulation of data can help you, as a consumer, make faster yet safer decisions, especially in stock markets.

IT Support for Technical Knowledge

Technical knowledge can be passed on from the IT desk to the center and promote the judicious use of market data.

The future of financial trading is automation. As more and more people and firms start applying their knowledge and combining it with deep learning algorithms, it will end up increasing the efficiency at which trading occurs.