Senator Paul Bettencourt (R-Houston)

$100k Homestead Exemption & Much More for all Taxpayers, saves the avg Texas Homestead 41.5% per year Announcement made by Lt. Governor Dan Patrick and Speaker Dade Phelan clears the way for bills passage

Austin, TX – Senator Paul Bettencourt (R-Houston), filed as primary author the largest property tax cut bill in Texas history, SB 2, the $18 billion property tax reduction plan, as announced by Lt. Governor Dan Patrick and Speaker Dade Phelan on Monday, July 10, 2023. Senator Bettencourt’s SB 2 will increase every Texas homestead exemption to $100k, for school ISD property tax bills. Additionally, SB 2 will have $7 billion worth of MCR compression of ISD M&O property tax rate cuts of 23.8%. Non-homesteaded real property valued at $5 million and under will receive a 20% circuit-breaker on appraised value increases as a 3-year pilot project. Senator Bettencourt also filed SB 3, with Senator Tan Parker (R-Flower Mound) as joint-author that will double the franchise tax exemption resulting in an estimated 67k Texas businesses no longer paying a franchise tax. It will also eliminate a “nuisance-tax” for 1.7 million taxpayers filing the no-tax-due forms for franchise taxes, saving businesses both time and money. The constitutional amendment for SB 2 & SB 3 has been filed as a House Joint Resolution, HJR 2 by primary author Representative Will Metcalf (R-Conroe). School districts are held harmless on these changes.

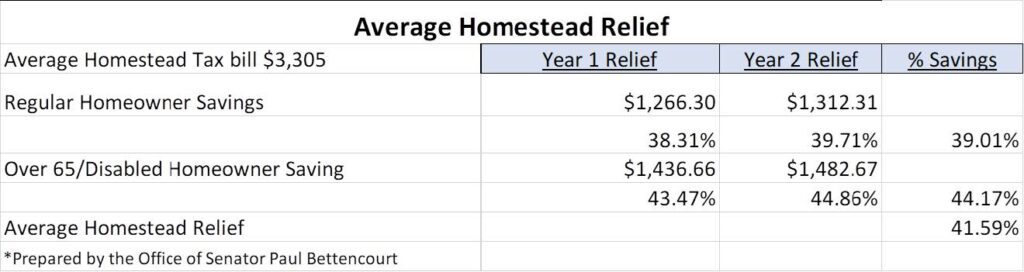

“TAXPAYERS WIN! All residential and commercial real property taxpayers WIN! 5.72 million Texas homesteaders WIN! With an eye-popping average 41.5% savings of $1373 year after year!” Exclaimed Senator Bettencourt. “It’s a record property tax cut totaling $18 billion dollars,” he added.

See the chart below for the expected SB 2 savings for 5.72 Million Homeowners on their ISD tax bill:

County Appraisal Districts (CAD) governance is also addressed in SB 2. For the first-time ever three county citizens will be elected county-wide to each CAD board of directors in non-partisan positions. In addition, the CAD board of directors will now select Appraisal Review Board (ARB) members, in each county of 75k population or greater. ISD’s get $642 million of I&S debt relief w/ the $100k HS exemption.

County Appraisal Districts (CAD) governance is also addressed in SB 2. For the first-time ever three county citizens will be elected county-wide to each CAD board of directors in non-partisan positions. In addition, the CAD board of directors will now select Appraisal Review Board (ARB) members, in each county of 75k population or greater. ISD’s get $642 million of I&S debt relief w/ the $100k HS exemption.

“Not only does Senate Bill 2 and 3, plus HJR 2 contain a record $18 billion dollar property tax relief, it has a huge $100k Homestead Exemption proposed Constitutional Amendment that must be voted on by the Public to get 5.72 Million Texas Homeowners an eye-popping savings of an average 41.5% cut over the next two years on their school district property tax bill.” Senator Bettencourt stated. “Plus, the public will be asked to approve the 20% non-homestead real property ‘circuit-breaker’ and a ‘catch-up’ for over-65 and disabled for the $15k homestead exemption increase adjustment from May 2022 state-wide election,” he concluded. (See the following page for detailed calculations on the average homestead property tax relief savings.)