Introduction

Options trading as we know it today took shape in 1973 with the formation of the Chicago Board Options Exchange (CBOE) and the Options Clearing Corporation (OCC). However, some literature traces the origin of options trading to the mid-fourth century BC. Throughout history, options have been traded in some form of over the counter (OTC) trading.

The History of Options Trading

Olive Harvest by Thales of Miletus – 4th Century BC

Aristotle accounts of Thales, a philosopher who studied the stars and used them to predict the Olive harvest. Thales knew that there would be high demand for olive presses if there were bountiful harvest. But since he didn’t have enough money to buy all the olive presses, he instead paid a small amount to the olive press owners for the right to use the presses at harvest time. Come harvest time, Thales made a fortune by selling these rights at a higher price. This was the earliest known form of call options.

The 1636 Tulip Bulb Mania

In the 17th century Holland, tulips were widely popular and considered a status symbol by the aristocrats. This popularity spread throughout Europe and the world, exponentially inflating the demand for tulip bulbs and a subsequent increase in the price. Tulip dealers started using call options to hedge against a future increase in tulip bulbs by locking-in specific prices.

London Options Trading Ban: 1700 – 1860

By the 18th century, organized options trading was growing worldwide, with their popularity attributed to their power for leverage. However, due to the bad reputation options trading garnered for their role in the financial crash of tulip mania, they faced increasing opposition. They were consequently banned in London from 1733 to 1860.

OTC Options Market in the US: 1872

Russel Sage is credited with creating the first options market in the US by structuring call and out options. The OTC options market pioneered by Russel Sage in the US later became the framework for the modern formal exchanges we know today.

Establishment of the CBOE and the OCC: 1973

The formation of the Chicago Board of Exchange (CBOE) and the Options Clearing Corporation (OCC) was the first real step towards the standardization of options trading. These two institutions were the Chicago Board of Trade’s brainchild, meant to increase diversity and trading opportunities for the exchange. This was a result of a decline in commodity futures trading.

Options Trading In 1900s vs Now!

The formation of CBOE and the OCC forever revolutionized options trading. Here are the most significant ways in which the present state of options trading has evolved:

Increased Liquidity

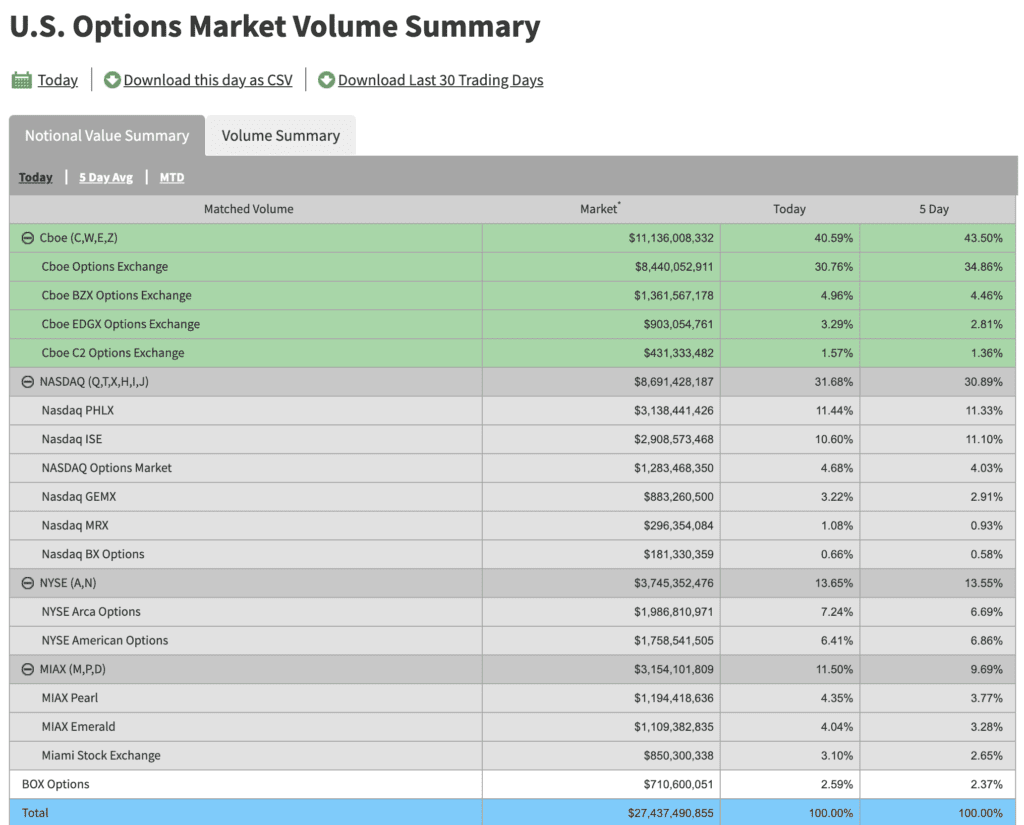

The present state of the options market is marked by high liquidity. Naturally, when the first OTC market for options was created, only a few traders and participants had even fewer underlying assets. Presently, options contracts can be structured on just about anything – from listed equities to commodities. In the US, for example, an average of 43 billion options contracts are entered daily with a notional value of ~$27.5 trillion.

High liquidity implies that there is a high supply and demand for the asset class. Hence, with increased liquidity, the spreads got much tighter now, reducing the cost of options trading, resulting in a fair market price.

Regulation

Presently, options trading is well regulated, with options exchanges adhering to strict trading rules. Regulation has ensured that contracts are standardized and the market is fair. For instance, some of the credible Option regulators in the United States establish and standardize the rules for trading options. These rules cover crucial aspects of margin trading, such as the number of tradable units, lot sizes, margin limits, etc. Some of the top tier Option trading regulators in the US are the Securities and Exchange Commission, Commodity Futures Trading Commission and Financial Industry Regulatory Authority.

Efficient Pricing

Before the operationalization of CBOE, option pricing was controlled by brokers as there was no correct pricing mechanism. Thus, only the elite class would remotely comprehend options contracts and buy them. Inherently, options pricing involves too many complexities, but thanks to the evolution of finance, standardized computational models for pricing can now be used for pricing options in the most affordable way. This has eliminated the entry barrier for novice traders willing to participate in the options market.

Convenience of Trading

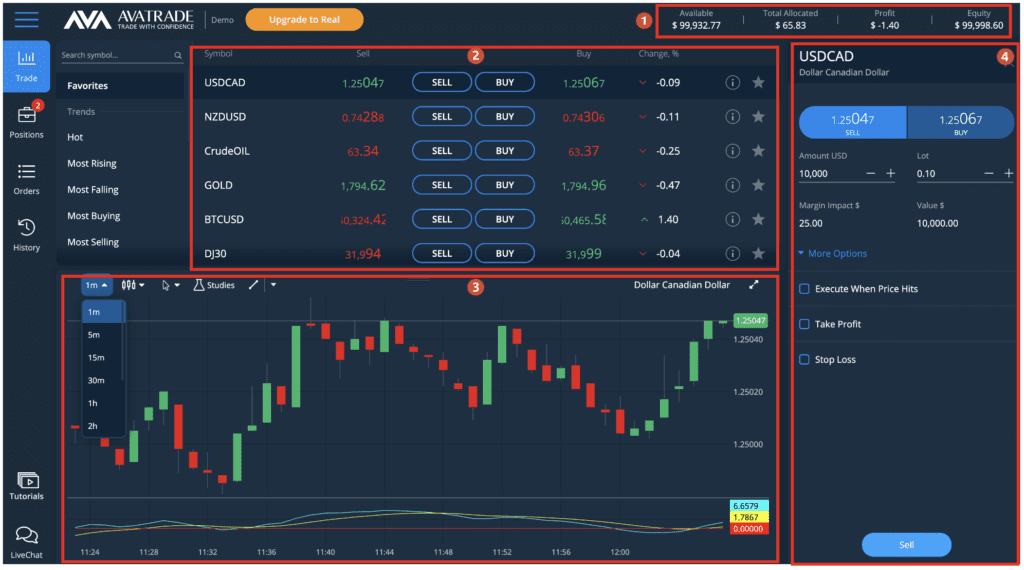

In the past, buyers would seek out brokers who in turn looked for sellers. This was a laborious task for all parties involved. With the evolution of technology, regular folks can now understand options pricing and trade options online at their convenience. There are many credible brokerage firms out there offering great services related to option trading. All you need to do is to pick a broker that is right for you and get started. The below snapshot is the interface of a popular option trading platform in 2021 – AvaOptions

- Display of your available balance, equity, profits and total allocated capital with real-time changes.

- Availability of all the popular options across the Forex, Commodity, Indices and Crypto markets.

- Charting Area – Various trading tools like different chart types, technical indicators, multiple timeframes, and unlimited customization.

- Buy/Sell Interface – One-click market entry using various order types.

Using these tools and a bit of basic education, you can gauge the options market accurately and trade them to make profits.

This implies how far options trading has come in just under two decades. We advise you to take advantage of the technology and grab the opportunities offered by this marker. Also, please know that trading in any market is risky and having the right education and expertise is important to protect your capital and make this process lucrative.

We hope you found this article informative. Please stay tuned for more interesting topics such as Bitcoin, etc. Cheers!