Joins Sean Hannity’s radio show to discuss priorities for fundamental tax reform

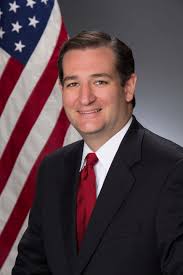

WASHINGTON, D.C. – U.S. Sen. Ted Cruz (R-Texas) today delivered remarks at the “Talking Tax’ event hosted by the Tax Foundation, where he outlined his priorities and objectives for fundamental tax reform. Later, he joined Sean Hannity’s radio show to discuss his reform proposals.

“A low, flat rate, a postcard – everyone ought to be able to fill out their taxes on a postcard,” Sen. Cruz said. “There is power to bold simplicity. And that’s what I’ve been urging the President and the Administration and the Senate – is let’s focus on jobs and economic growth. And let me tell you one of the most potent tools for jobs and economic growth and tax reform…A big part of my speech today, immediate expensing. What does that mean? That means if you’re a farmer, and you buy a new tractor, you can immediately deduct that against your taxes.”

Sen. Cruz continued, “That produces millions of jobs, it raises wages and it’s incredibly pro-growth. And what I’m encouraging people is let’s focus on Main Street, on jobs, on working class, on the men and women with callouses on their hands.”

Listen to Sen. Cruz’s interview here.

Several news outlets covered Sen. Cruz’s remarks. Select coverage is below:

Dallas Morning News: Cruz: Congress must overhaul tax code or suffer one of ‘greatest missed opportunities in modern history’

Texas Sen. Ted Cruz on Wednesday urged his colleagues to fulfill a ‘fundamental promise’ to overhaul the tax code, saying that Congress has a once-in-a-generation opportunity to ‘produce incredible results.’ Cruz, a key conservative voice, spoke in sweeping terms about a tax revamp that would center on growth, simplicity and fairness. He offered a vision of a tax system with reduced rates, fewer loopholes and the ability for most Americans to file their taxes on a postcard. And he invoked former President Ronald Reagan, who oversaw a major tax overhaul, to frame the stakes. ‘Will we step up and seize this opportunity?’ Cruz said in a 35-minute speech hosted by the Tax Foundation, a conservative-leaning Washington think tank. ‘Or will it be one of the greatest missed opportunities in modern history?’

Texas Tribune: Texans Ted Cruz and Kevin Brady push tax code overhaul on Capitol Hill

‘We’ve been given an historic opportunity, an opportunity to produce incredible results for the men and women who elected us,’ said Cruz in a high-profile speech hosted by the conservative Tax Foundation. ‘The promise to remodel our antiquated, bureaucratic, ineffective tax system with the objective of creating more jobs, higher wages, more opportunity.’ Cruz said his plan to overhaul the tax code was based off of three principles: flat, simple and fair. His proposal included creating a low, flat tax rate and allowing people to file their taxes on a postcard. He also encouraged Congress to eliminate the estate tax and permit businesses to fully and immediately deduct expenses related to capital investments.

The Hill: Cruz lays out his tax reform goals

“One of Cruz’s top goals is for a tax-reform bill to allow businesses to immediately write off the full costs of their capital investments, a concept known as ‘full expensing.’ Cruz said that full expensing would be a ‘massive simplification’ of the code and would benefit Main Street. ‘One of the most important reforms we ought to include in tax reform is full and immediate expensing,’ he said.”

CNN: Ted Cruz pitches tax reform: ‘Let’s simplify the tax code’

Cruz on Wednesday pitched the simplification of the tax code and is pushing ‘immediate expensing.’ ‘What that means is that businesses, farmers, ranchers, if you spend money on a capital investment, you can immediately expense that and deduct it from what you’re paying taxes on,’ Cruz said. […] Cruz said a victory will be ‘whatever can get 50 votes in the Senate.’ He added that he would vote for something resembling the tax cuts from the George W. Bush administration. ‘That would be improvement from the status quo,’ Cruz said. ‘I hope we do a lot better. I mean, we’ve got an opportunity. If we come in with full expensing, if we simplify the tax code. If we cut the rates, we have an opportunity to see millions of new jobs created to really raise wages.’