Outlines priorities for fundamental tax reform in the 115th Congress

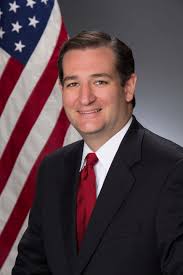

WASHINGTON, D.C. – U.S. Sen. Ted Cruz (R-Texas) today delivered the keynote remarks at a ‘Talking Tax Reform’ event hosted by the Tax Foundation. There, Sen. Cruz outlined seven critical elements for tax reform in the 115th Congress, based on three key principles of growth, simplicity, and fairness.

“Now is our moment to remake our tax system from the ground up, employing conservative principles to create a new tax code that is simpler, flatter, and fairer,” Sen. Cruz said. “Much like Ronald Reagan, today’s conservatives hold to the simplest of ideals: that the best-utilized tax dollar is the tax dollar that goes uncollected. The best place for a taxpayer’s money is with that taxpayer, not the federal government.”

Sen. Cruz outlined seven critical elements of fundamental tax reform:

- Create a Low, Flat Rate:Currently there are seven individual tax brackets, with rates as high as nearly 40 percent. We should have one low flat tax rate.

- File Taxes on a Postcard: Each year, more than 90 percent of taxpayers seek help to prepare their returns, either through tax preparers or tax preparation software, costing them $99 billion. Simpler, flatter taxes will save Americans time and money, and allow them to file their returns on a postcard.

- Allow Immediate Expensing: Domestic capital investment increases productivity, which results in more jobs and higher wages. And that means higher living standards for American families.

- Lower the Corporate Rate: Companies are leaving the United States in droves, and taking their jobs with them. By lowering the corporate rate to 15-20 percent, America becomes competitive with the rest of world.

- Encourage Repatriation: Current law discourages companies from bringing home foreign earnings. Moving to a territorial system would ensure foreign earnings are not double-taxed.

- End the Death Tax: More than 99 percent of U.S. employer firms are small businesses, many of them family-owned. The death tax establishes a burden that prevents families from being able to keep their businesses running from one generation to the next, and should be put to an end.

- End the Alternative Minimum Tax (AMT): The AMT applies to four million households, and requires millions of taxpayers to calculate their taxes twice, once under the regular tax code and again under the AMT. Ending the AMT will drastically simplify taxes for millions of American families.

Watch Sen. Cruz’s full remarks here.